All blogs

The Modern CFO: Leveraging AI for Fraud Protection

Ever feel like technology is moving at warp speed? We're constantly hearing about amazing new things AI can do, like those super-smart programs that can understand and even generate human-like text. But with all this new tech comes a new challenge: sneaky people are finding new ways to commit fraud. Think of it like this: as the world gets more digital, there are more doors for thieves to try and pick.

Luckily, the same powerful AI that could be used for bad things can also be used to stop bad things. It's like fighting fire with fire, but in a good way! This AI can help businesses protect themselves from financial threats by spotting suspicious activity that humans might miss. It's like having a super-powered detective constantly watching for clues. In this post, we'll explore how this works and how it's changing the game for businesses fighting fraud.

How AI Uncovers Hidden Patterns and Anomalies

Imagine having a detective who can analyze thousands of clues in the blink of an eye, spotting tiny inconsistencies that would be impossible for a human to see. That's essentially what AI fraud detection does. It's like having a super-powered assistant constantly watching over your financial transactions, looking for anything suspicious.

At the core of AI fraud detection is its incredible ability to analyze patterns and flag anomalies. Think of it like this: if you always buy groceries on Saturdays, and suddenly there's a huge purchase of electronics on a Tuesday, that might raise a red flag. AI can spot these kinds of unusual activities across massive amounts of data, whether it's checking invoices for strange sender information or flagging suspicious payment requests. The secret? It uses something called "machine learning," which means it gets smarter over time by learning from new information. This helps it adapt to new tricks that fraudsters might try, making sure it stays one step ahead. So, if you’re wondering how to keep your money safe in today’s digital world, AI fraud detection is a powerful tool to have on your side. In this post, we'll dive deeper into how this works and why it's so important.

AI for Email Fraud Prevention

Ever feel like your inbox is a bit of the Wild West? Especially if you work in a department that handles lots of invoices and emails – think accounts payable, for example. It's like trying to find a needle in a haystack, sifting through tons of messages every single day. And let's be honest, with things like seasonal sales or changes in the economy, those haystacks can get even bigger!

Now, imagine if you had a super-smart assistant that could instantly spot anything fishy. That's where AI fraud detection comes in, and it's a game-changer, especially when it comes to email security. Think of it like this: AI can analyze every tiny detail of an email – who sent it, what's in the subject line, even the links hidden inside the message – with incredible accuracy. It's like having a digital detective that never gets tired and never misses a clue. This "detective" uses machine learning, which basically means it learns to recognize patterns of fraud, like fake email addresses or suspicious links, that a human might easily overlook. So, if you're worried about email scams and keeping your business safe, stick around – we're going to dive into how AI fraud detection can be your best defense!

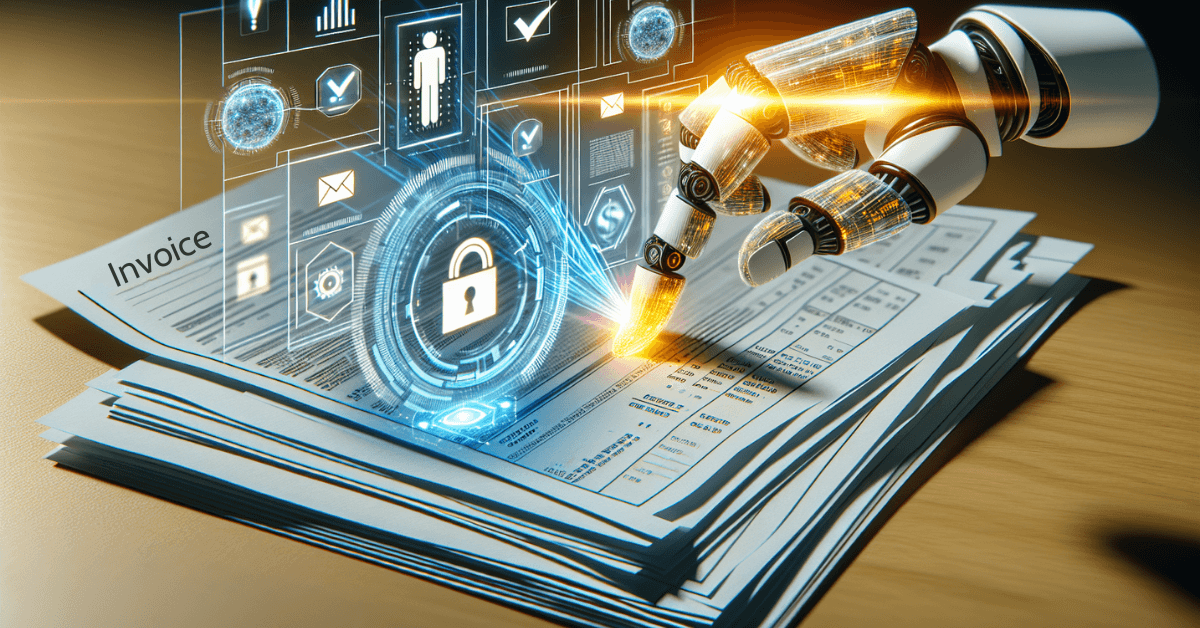

Streamline Invoice Verification with AI Automation

So we've established that AI can be a super-smart email detective. But its talents don't stop there! Let's talk about something that can be a real headache for any business: verifying invoices. You know, those bills you get from suppliers? Usually, someone has to manually check if they're real, make sure they match up with what was ordered, and cross-reference everything with records. It's a long, tedious process, and let's face it, humans aren't perfect. We get tired, bored, and sometimes we just miss things. This can lead to mistakes in the financial records, which is never good.

This is where AI fraud detection really shines again. It completely revolutionizes how invoices are handled. Imagine an AI system that can zip through mountains of data in the blink of an eye, spotting patterns and red flags that might point to a fake or duplicate invoice. Pretty cool, right? By connecting with existing accounting systems and databases, AI automation makes the whole verification process super smooth and efficient. It ensures that only legitimate invoices are paid, minimizing the risk of losing money to fraud or errors.

But the best part? By taking over these routine invoice verification tasks, AI frees up valuable time for finance professionals. Instead of spending hours checking invoices, they can focus on more important things, like analyzing financial trends, improving cash flow, or finding ways to save the company money. Basically, AI allows them to work on high-priority projects that actually make a difference to the business. It’s like having an extra team member who never needs a coffee break and is always on the lookout for fraud!

So, as we’ve seen, AI fraud detection isn’t just a futuristic idea – it’s a powerful tool that’s already making a real difference for businesses of all sizes. From sniffing out suspicious emails to streamlining the often-tedious process of invoice verification, AI offers a robust defense against ever-evolving fraud tactics. It’s not about replacing human judgment entirely, but rather augmenting it, providing that extra layer of security and efficiency that’s so crucial in today’s digital landscape. By automating routine tasks and uncovering hidden patterns, AI empowers businesses to not only protect their bottom line but also free up valuable time and resources to focus on growth and innovation. In a world where technology is constantly evolving, embracing AI fraud detection isn't just a smart move—it's becoming a necessity for staying ahead of the game and safeguarding your future.